[ad_1]

Ethereum price broke above $3,9500 barrier again on Feb. 22, while Bitcoin price rally struggles for momentum: 3 vital market metrics suggest ETH could further extend its lead over BTC in the weeks ahead.

Ethereum (ETH) and Bitcoin (BTC) are historically closely correlated, but in 2024, ETH seems to have gained the upper hand. A deep dive into the on-chain data trends and expert analysis provides key insights into which asset would come out on top as the year unfolds.

Is Ethereum better than Bitcoin in 2024?

So far in 2024, Ethereum and Bitcoin, the two largest assets in the crypto sector have attracted billions of dollars in capital inflows. As of March 2024, BTC is trading at historic all-time highs of $71,200, while ETH price attempts to establish a steady support above the $4,000 milestone.

However, a closer look at the price charts shows that ETH currently has the upper hand having outperformed BTC by 7% in terms of year-to-date performance.

The chart above shows that ETH price has increased 79% between Jan 1 and March 11 2024, which is significantly higher than Bitcoin’s 72% price gains.

However, while ETH currently has the upperhand, to determine which asset is a better value for money in 2024, it is important to examine the market catalyst driving both assets.

First, it is important to note that both assets are driven by separate narratives and market catalysts in 2024.

For Ethereum, the ongoing ETH ETF filings, liquidity staking derivatives, the Eigen-layer re-staking and Dencun upgrade have emerged major themes within the ecosystem in Q1 2024. Meanwhile, the dominant themes for Bitcoin are the rapidly growing demand from the 10 newly-approved BTC ETFs and the upcoming halving event scheduled for April 19 2024.

These key events have triggered diverse changes in on-chain transaction trends and investment patterns across both ecosystems, leading to Ethereum price outpacing Bitcoin.

3 reasons Ethereum price could outperform Bitcoin in 2024

- Retail investors are rallying behind ETH as Institutions dominate BTC markets

The US Securities and Exchange Commission (SEC) approved 10 new Bitcoin ETFs on Jan 11 2024 marking a real milestone moment for the cryptocurrency sector. Within the 2 months post-launch the ETFs have rapidly acquired about 800,000 BTC, about 4.2% of the total supply in circulation.

Evidently, Bitcoin price has benefited immensely from record-breaking inflows made by the corporate institutional investors in 2024. But interestingly, the ETF’s dominance has triggered a skittish reaction among BTC retail investors, much to the apparent advancement of the Ethereum ecosystem growth.

Santiment’s total holders metric estimates the total number of active or funded wallet addresses that currently exist on a blockchain network. It serves a proxy for measuring the level of adoption among retail investors and the mass markets.

In the last 50-days dating back to Jan. 21, the Ethereum network has attracted 3.59 million new holder addresses, while 200,000 BTC addresses emptied their wallets and exited the network.

This rare on-chain trend suggests that the retail mass markets are overwhelming behind Bitcoin. As Bitcoin becomes more concentrated in the hands of fewer whale investors and corporate entities, it puts BTC price at risk of market manipulation and external shock from the macroeconomic fronts.

The significant increase in new holder addresses on the Ethereum network compared to the number of BTC addresses emptying their wallets suggests a divergence in retail investor sentiment between the two cryptocurrencies.

Firstly, this trend indicates that retail investors are increasingly favoring Ethereum over Bitcoin, potentially due to Ethereum’s promise of profit-optimization and passive income from its low-risk staking yield to its retinue of decentralized finance applications (DApps).

Furthermore, the growing dominance of institutional investors and corporate entities in the Bitcoin market introduces a new layer of uncertainty and potential risk. While institutional adoption has been a key driver of Bitcoin’s recent price rally, it also increases the susceptibility of the market to large-scale sell-offs or coordinated trading strategies by these influential players.

In the event of a tradfi market downturn or macroeconomic policy changes, the concentrated ownership of Bitcoin in the hands of highly-sensitive Wall Street players could exacerbate BTC price declines and lead to heightened market volatility.

- Bitcoin Miners Trading Bearish while Ethereum Node Validators remain bullish

The divergence in the current trading disposition of Bitcoin miners and Ethereum node validators is another vital market catalyst that could drive ETH price further ahead of BTC. On the Bitcoin network, miners dedicate computing resources to validate transactions and secure the network in exchange of BTC block rewards. Ethereum, since its transition to Proof of Stake (PoS), now relies on its node validators for that critical function.

Bitcoin’s next halving event slated for April 19, will see miners’ rewards slashed from 6.25 BTC to 3.13 BTC. With the event now less than 40-days away Bitcoin miners have entered a selling frenzy in a bid to cash-in before the halving date.

As of Dec. 29 2023, Bitcoin miners held a total of 1.96 million BTC. But as the halving date drew closer, the miners rapidly offloaded 300,000 BTC, cutting down their balances to just 1.93 million BTC at press time on March 11 2024.

Valued at the current prices of $71,200, the miners have sold $21.5 billion worth of BTC in Q1 2024 ahead of the halving.

If the Bitcoin miner’s selling trend persists, it could slow down the BTC price rally, especially in comparison to Ethereum whose node validators have been accumulating more coins in recent months.

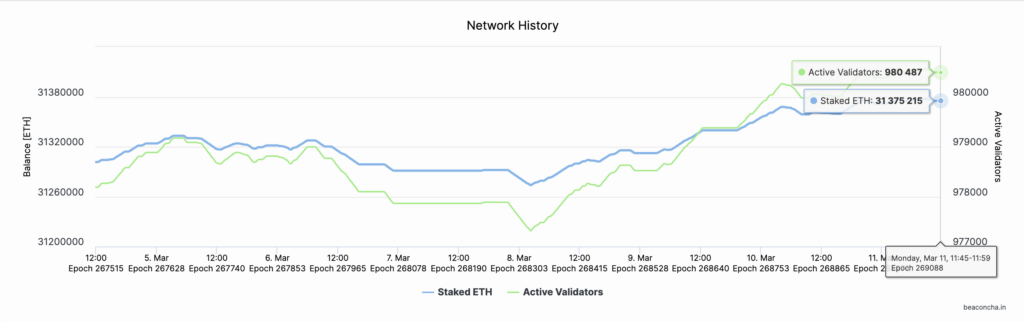

Ethereum node validators have doubled down on their bullish positions, depositing 2.4 million ETH worth $9.7 billion into the beacon chain staking contracts since Jan. 2024, meanwhile Bitcoin miners entered a $21.5 billion selling spree.

At press time on March 11, the total staking deposits on the ETH 2.0 beacon chain stood at $1.4 million ETH, representing a 2.4 million ($9.7 billion) increase in 2024.

Unlike Bitcoin miners, Ethereum node validators continue to double-down on their long-term bullish positions as ETH price edges further above the $4,000 mark. Positive speculations surrounding the Dencun upgrade, and progress of ETH ETF filings are key catalysts incentivizing ETH stakeholders’ bullish disposition.

With these catalysts still in play, ETH could witness even more coins taken out of circulation, while BTC circulation supply increases as miners increase selling pressure as the halving approaches.

VanEck’s Head of Digital Assets to Cryptoquant also echoed this stance in a recent interview with Cryptoquant.

“Over the medium term, ETH tends to outperform BTC in the halving year, right? So I don’t want to lose the forest for the trees. I don’t think there will be flippening, but I do think when the year (2024) is said and done, ETH will have outperformed BTC.

If these scenarios play out as predicted, ETH price will likely extend its lead over BTC in the weeks ahead.

- Technical Indicators Highlight Ethereum’s Path to $5,000

In summary, Ethereum is expected to pull greater retail market demand than Bitcoin and also experience a temporary decline in circulation supply amid rising staking deposits. These key factors put ETH price on a path to a new all time highs above $5,000.

ETH is currently trading above the $4,030 range at the time of writing on March 11. IntoTheBlock’s in/out of the money chart shows that Ethereum has a relatively clear path to reaching a new all time-high.

As seen below, the chart highlights the $4,500 territory as the largest resistance cluster above the current prices. At that range, 617,760 addresses had acquired 1.6 million ETH at the average price of $4,557.

Considering that they have been holding at a loss for 3-years, many of those holders could move to close their positions once Ethereum prices approach their break-even point.

If ETH price can establish a steady support level above that $4,500 area, it could potentially propel ETH price to a new all-time high above $5,000.

[ad_2]

Source link