[ad_1]

Analysts at Pantera Capital see a half-trillion-dollar opportunity in bringing decentralized finance to Bitcoin, potentially making Bitcoin-based decentralized apps top assets in crypto.

Pantera Capital analysts have identified a significant opportunity worth over half a trillion dollars in bringing decentralized finance (defi) to the Bitcoin blockchain, potentially positioning Bitcoin-based decentralized applications as leading assets in the crypto space.

In a recent email newsletter, Pantera Capital highlighted the potential for Bitcoin to accumulate $450 billion in liquidity through defi projects, particularly if they achieve similar market shares as those that can be seen on the Ethereum blockchain right now.

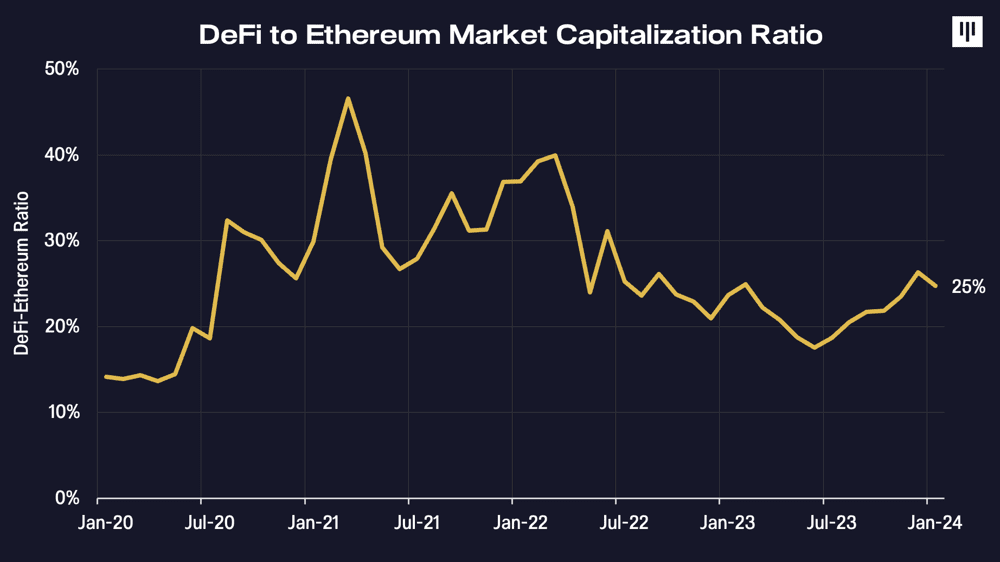

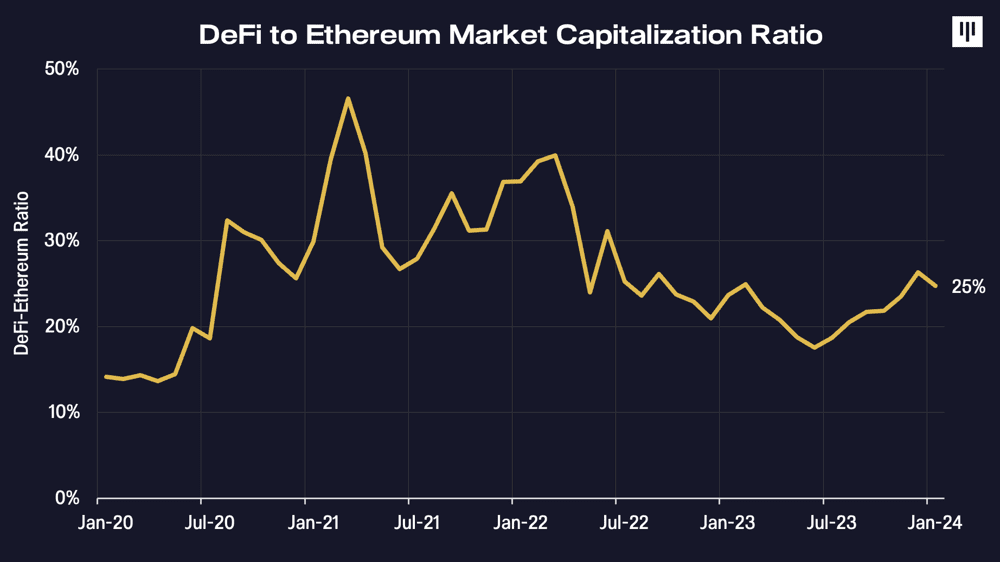

So far, Ethereum dominates the defi landscape, hosting the majority of activity, according to Pantera Capital. Historically, decentralized applications on Ethereum have represented between 8% and 50% of Ethereum’s market capitalization, with the current figure standing at approximately 25%. Extrapolating these proportions to Bitcoin suggests the potential for the network to attract around $225 billion in value.

Moreover, Pantera Capital predicts that the leading decentralized application on Bitcoin could eventually reach a valuation of $20 billion, firmly establishing itself among the top most valuable assets in the ecosystem.

“This would place it squarely in the top 10 most valuable assets in the crypto ecosystem. Bitcoin is nearly back to being a trillion-dollar asset. Yet, it still holds an untapped half-trillion dollar opportunity.” Pantera Capital

In mid-January, Pantera Capital emphasized the importance of selecting tokens with robust underlying protocols and proven product-market fit, expecting them to outperform in the upcoming cycle.

Although Pantera Capital did not name specific tokens, the firm said that over the long term, token selection will be “paramount because outperformance will be on a case-by-case basis and not necessarily in a certain sector or based on fickle, short-lived speculative narratives.” The hedge fund also said it expects the growth of defi on the Bitcoin blockchain to continue in the foreseeable future, with total value locked on the platform potentially rising to 1-2% of Bitcoin’s market cap.

[ad_2]

Source link