[ad_1]

Ethereum price soared to a new 2024 peak above $3,740 on March 4. ETH 2.0 staking trends suggest the Dencun upgrade could usher in more gains.

After outperforming Bitcoin (BTC) price in February 2024, Ethereum bulls have doubled-up on their staking positions in the first week of March.

With the anticipation of further upside after the Dencun Upgrade, ETH price looks set to make another attempt at reclaiming $4,000 as the week unfolds.

ETH 2.0 staking deposits cross $115 billion milestone

In early February, ETH developers confirmed March 13 for the mainnet launch of the Dencun upgrade. The critical “proto-danksharding” feature is billed to reduce transaction costs on Ethereum as well as auxiliary Layer-2 networks.

Ethereum price reached a new 2024 peak of $3,743 on March 5, sparking concerns that investors could start booking profits.

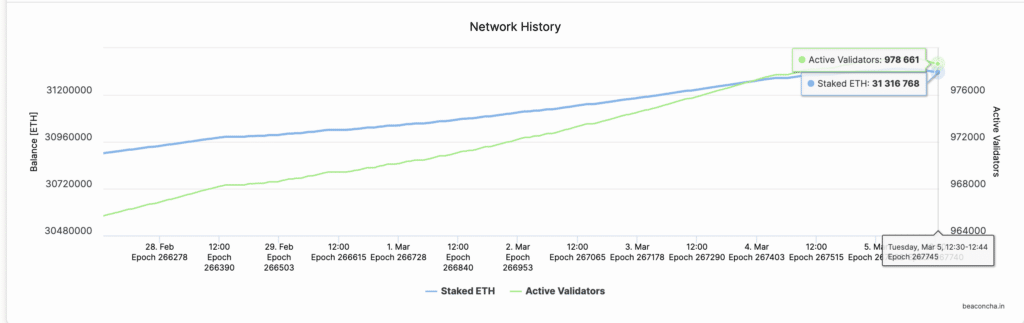

But with the Dencun upgrade now 1-week away, on-chain data from the ETH 2.0 beacon chain shows that investors have maintained a bullish outlook staking their coins rather than exiting at the current historic prices.

The total staking deposits on the ETH Proof of Stake (PoS) network crossed 31.3 million ETH rose from 30,569,041 ETH. This marks a significant milestone as the total stake value has now hit the $115 billion mark.

Rising staking deposits generate positive traction for any Proof-of-Stake network. Firstly, it enhances network security and stability, which could be critical amid euphoric network activity.

Secondly, it signals that despite elevated prices, ETH investors are playing the long-game, with high optimism surrounding the Dencun upgrade.

Overall, Ethereum staking hitting $115 billion while prices are trending at a 3-year peak indicates an overwhelming positive conviction among investors that the upcoming network improvements could drive the rally further.

Forecast: can Ethereum price reach $4,000 ahead of Dencun upgrade?

Drawing data-driven insights from the staking trends analyzed above, Ethereum price currently appears primed for further upswing toward $4,0000 ahead of the Dencun upgrade slated for March 13.

First, ETH has to establish steady support above $3,800. However, the bulls must withstand the profit-taking wave from the final cluster of 8.7 million addresses that acquired 3.4 million ETH when prices last reached $4,000 in the 2021.

Breaking above this final resistance level, could set the stage for ETH price to advance towards its all-time highs above $4,000, as predicted.

On the downside, the bears could invalidate this ETH price prediction by staging another reversal below $3,000. But as observed in the past week, the buy-wall at the $3,100 territory offers significant short-term support for ETH price.

[ad_2]

Source link