[ad_1]

Ethereum’s Shapella upgrade earlier this month was the culmination of a nearly decade-long effort to shift to proof-of-stake (PoS). The upgrade, which enables withdrawals of staked ETH, followed the launch of the Beacon Chain in November 2020 and the Merge last September, when the proof-of-work chain was finally laid to rest.

In 2019 and 2020, DeFi blossomed on Ethereum, with plain old vanilla ETH supplying more than half of TVL during those two years. ETH holders could only earn yield by lending or LPing on an AMM. Ethereum’s shift to PoS then created new opportunities to earn yield with ETH.

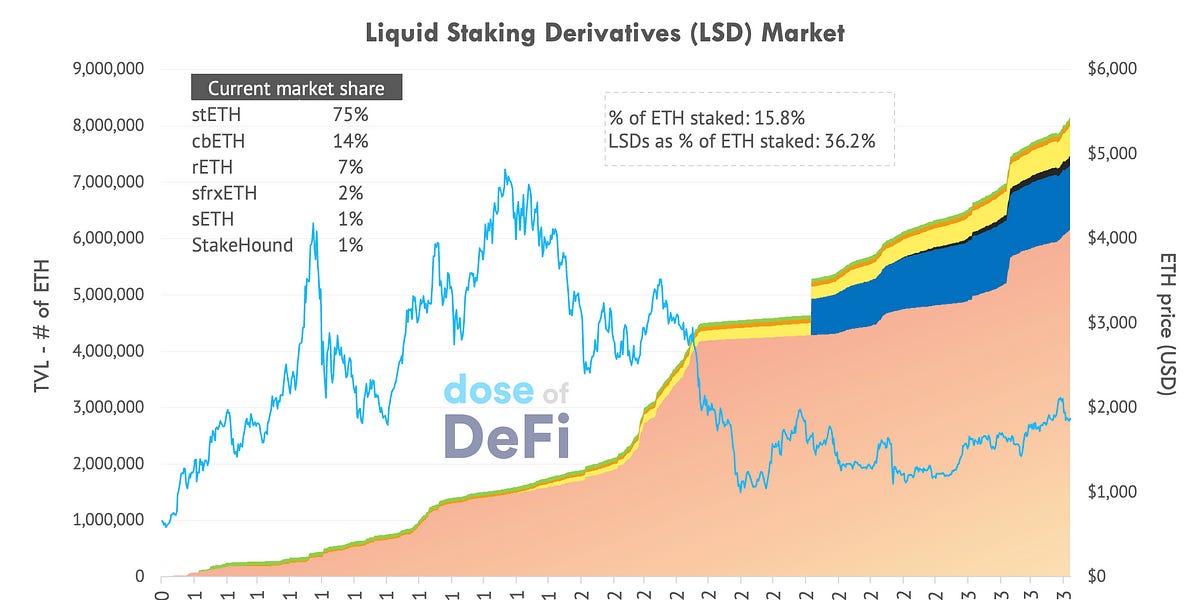

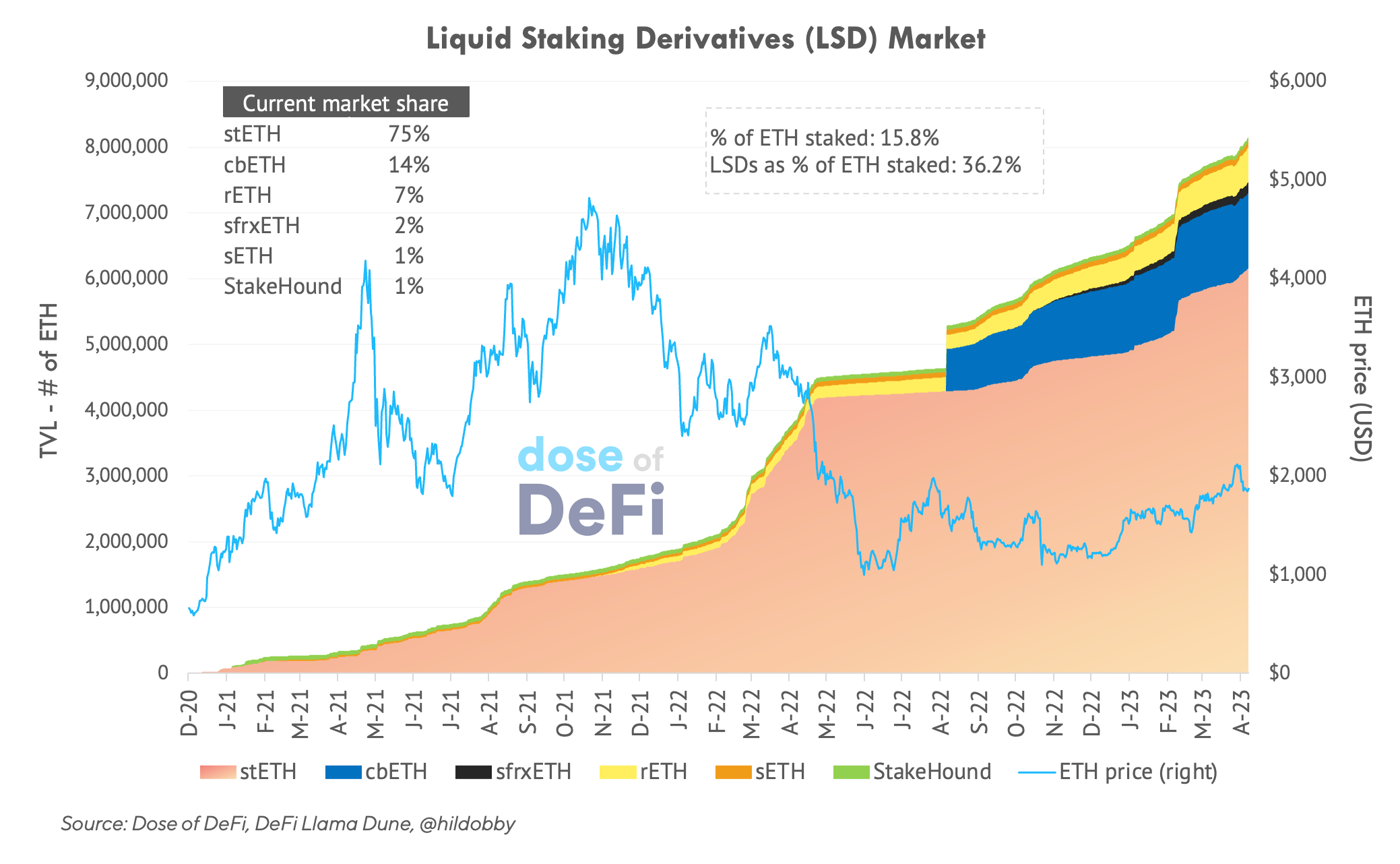

Soon after the launch of the Beacon Chain, we started to see a preview of such yield opportunities, in the form of liquid staking derivatives (LSDs) – although some are trying to rebrand to LSTs (liquid staking tokens). Specific examples include Lido’s stETH, Coinbase’s cbETH, and Rocketpool’s rETH, all of which allow access to ETH staking yield by simply holding a token. LSDs have grown consistently over the past two years – irrespective of the price of ETH – and their popularity is set to accelerate now that withdrawals have been enabled by Shapella.

Yet these tokens are just the start. The much-anticipated EigenLayer, which enables ETH restaking to earn additional yield, launched on testnet earlier this month. The protocol could drastically lower the cost of building complex applications on Ethereum. And it might also usher in a new era of ETH staking tokens, which would redefine the core base of assets for DeFi protocols.

There’s already high-profile backing of this idea of an ETH-staking-token era. At the MEVnomics.wtf online summit last month, Gauntlet founder Tarun Chitra laid out a compelling vision:

“There will inevitably be some notion of ETF-ization, where people will want different classes of ETH yield. There will be:

The most high grade ETH yield that is just pure staking.

Slightly riskier [and higher] ETH yield, which is staking plus submitting oracle updates.

Slightly higher risky version [of ETH yield] with data availability plus oracle updates.

I can imagine people fractionalizing [for] what level of ETH [yield] risk do you want.”

This future assumes the widespread adoption of Eigenlayer’s ETH restaking protocol. EigenLayer would enable Ethereum validators to provide other infrastructure services in return for additional rewards. EigenLayer does not enable the tokenization of these additional rewards, but neither does Ethereum for staked ETH (and that didn’t stop the LSD market from forming). A deeper analysis of the LSD market (as follows) will help illustrate how the rise of restaking products – or the ETF-ization of ETH yield as Tarun calls it – will play out.

When DeFi arrived as a meme and a market in 2019, there were three clear market segments: lending, DEXs and stablecoins. LSDs have cemented themselves as the fourth major market in the DeFi space.

Lido (stETH) raced to an early lead and has not looked back. It onboarded dozens of well-known validator companies and then focused on DeFi integrations. It also launched a Curve stable pool and showered it with LDO token incentives to build on-chain liquidity. Throughout 2021 and early 2022, this strong on-chain liquidity helped stETH maintain a 1:1 peg with ETH, despite the fact that stETH can only be redeemed for ETH through Lido after withdrawals are enabled (expected next month).

Once on-chain liquidity was established, Lido then moved to integrate stETH into lending protocols. Aave also added it as collateral in February 2022. This led to a popular recursive borrowing strategy: supply stETH as collateral, borrow ETH against the stETH, buy stETH with borrowed ETH. Rinse and repeat. This became a great leveraged ETH-staking strategy, but ran into problems in the days of market volatility during the Terra and 3AC collapse, when stETH depegged from ETH.

-

Coinbase has the second largest LSD, cbETH, mirroring its second place in the stablecoin market with USDC. cbETH launched in October 2022 with the advantage of being able to attract the large swath of retail and institutional investors that custody ETH on Coinbase. Just as its fiat onramp makes it a major player in the stablecoin market, the same is true for LSDs. It also charges the highest fees (25% on yield earned). Coinbase’s biggest concern is regulation. It’s hard to imagine Mr. Gensler ignoring a token that promises yield, given the current intense scrutiny on Coinbase. But regulation isn’t Coinbase’s only problem. It’s set tosee more competition in the exchange lane, with Binance announcing just this week that it’s entering the LSD market.

-

Rocket Pool is the most decentralized of the major LSDs. It’s also the oldest, with roots dating back to 2016. Importantly, being a Rocketpool node operator is permissionless. With the release of its Atlas upgrade last week, node operators only need 8 ETH to join the protocol, giving them skin in the game (in addition to needing to stake RPL). The remaining 24 ETH comes from purchases of rETH, Rocket Pool’s LSD.

-

Frax launched its LSD (sfrxETH) last November. It’s fairly centralized, but intends to shift to a model similar to Rocket Pool in the future. Frax has carved out market share with effective liquidity mining strategies, as well as by integrating into its Frax Lend product.

There are at least a half dozen smaller LSDs (Stakewise, Ankr, Stakehound, etc.) looking to carve out a niche in the growing market. It will be hard to offer something novel for vanilla LSDs, but EigenLayer and ETH restaking represent an opportunity to win market share.

EigenLayer was founded by Sreeram Kannan, a professor at the University of Washington and director of the UW Blockchain Lab. Over the past few months, EigenLayer has been cited by Vitalik and other core Ethereum developers as a solution to Ethereum’s thorniest problems. It also just announced a massive $50m Series A fundraising, led by Blockchain Capital.

Bridget Harris, a student at Stanford, explains the appeal of restaking well:

“Often, developers have to choose between innovating outside of Ethereum – and not being able to leverage its validator set – versus building on the EVM but having to adhere to the above constraints…These projects need actively validated services (“AVS”) in order to achieve proper validation. However, building an AVS comes with significant restraints.

EigenLayer proposes a solution to these issues by applying the security Ethereum’s validator set provides to these modules: in their words, pooled security via restaking and free-market governance.”

Rather than bootstrapping a network, EigenLayer would recruit Ethereum validators to run additional services for specific applications. The key is leveraging the ETH staked behind the validators to ensure that they perform the tasks they’re receiving awards for. To participate, validators must assign their ETH staking withdrawal address to EigenLayer. This would enable the slashing of a validator’s ETH if it doesn’t act according to the specific conditions it agreed to, as approved by EigenLayer governance.

Through this model, EigenLayer could act as a “staging network for Ethereum”, testing out new features before implementing in the core protocol. It could also align validators to implement MEV smoothing, or redistribution of MEV profits, by slashing any validator that tries to take more than its fair share.

Ultimately, the core premise of EigenLayer is the incentive for ETH holders to seek a higher yield.

In its whitepaper, EigenLayer explicitly states that it is not enshrining LSDs into the core protocol..

Still, we can see the writing on the wall. It will be more difficult to create tokenized versions of yield earned from ETH restaking. LSDs are all packaging the same underlying yield from Ethereum protocol rewards, although they have introduced additional returns from running MEV-boost. EigenLayer envisions hundreds of different yield opportunities for ETH validators to partake in. Making these fungible will certainly be a challenge.

We believe that liquid restaking derivatives (LRDs?) will take the same form as the current crop of LSDs. EigenLayer is designed to accept LSD tokens themselves, so an investor could stake stETH or cbETH within EigenLayer and then delegate to a validator that is running a service with higher rewards. This is a good way of integrating with the existing system and validator set, but wouldn’t give sufficient fungibility and liquidity to interact with DeFi. A new token that captures the additional yield is needed.

For aspiring liquid restaking derivatives (okay, tokens), the most important thing is to build around a core service that is much needed by Ethereum applications: one that is secure and can offer high rewards. After this, the focus should be on how the LSD market first formed. The simple formula (pioneered by Lido) is:

Step 1. Recruit a number of top staking companies to serve as trusted validators.

Step 2. Launch a token that captures the yield and build on-chain liquidity through Curve or Balancer (Aura also helps).

Step 3. Ensure the token is accepted as collateral on major lending platforms.

This might not seem that complicated, but the increasingly hostile regulatory environment around tokens with yield is sure to muddle the playbook.

-

WBTC supply on Ethereum has declined by over 50% Link

-

Delphi Labs proposes BORG, a new framework for cryptolaw entities Link

-

Gearbox releases v3 Link

-

a16z launched Magi, an rust client for the Optimism rollup stack Link

-

Bancor launches new DEX Carbon Link

-

ETH Tokyo winners Link

-

Ameen announces Hai, a multi-collateral RAI fork on Optimism Link

-

0x reveals new suite of integrated APIs Link

That’s it! Feedback appreciated. Just hit reply. Written in NYC, great to be back but wish the weather was more spring.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. All content is for informational purposes and is not intended as investment advice.

[ad_2]

Source link