[ad_1]

While a possible spot Ethereum ETF approval looms ahead, Grayscale experts believe an upcoming technological improvement is behind recent price upticks.

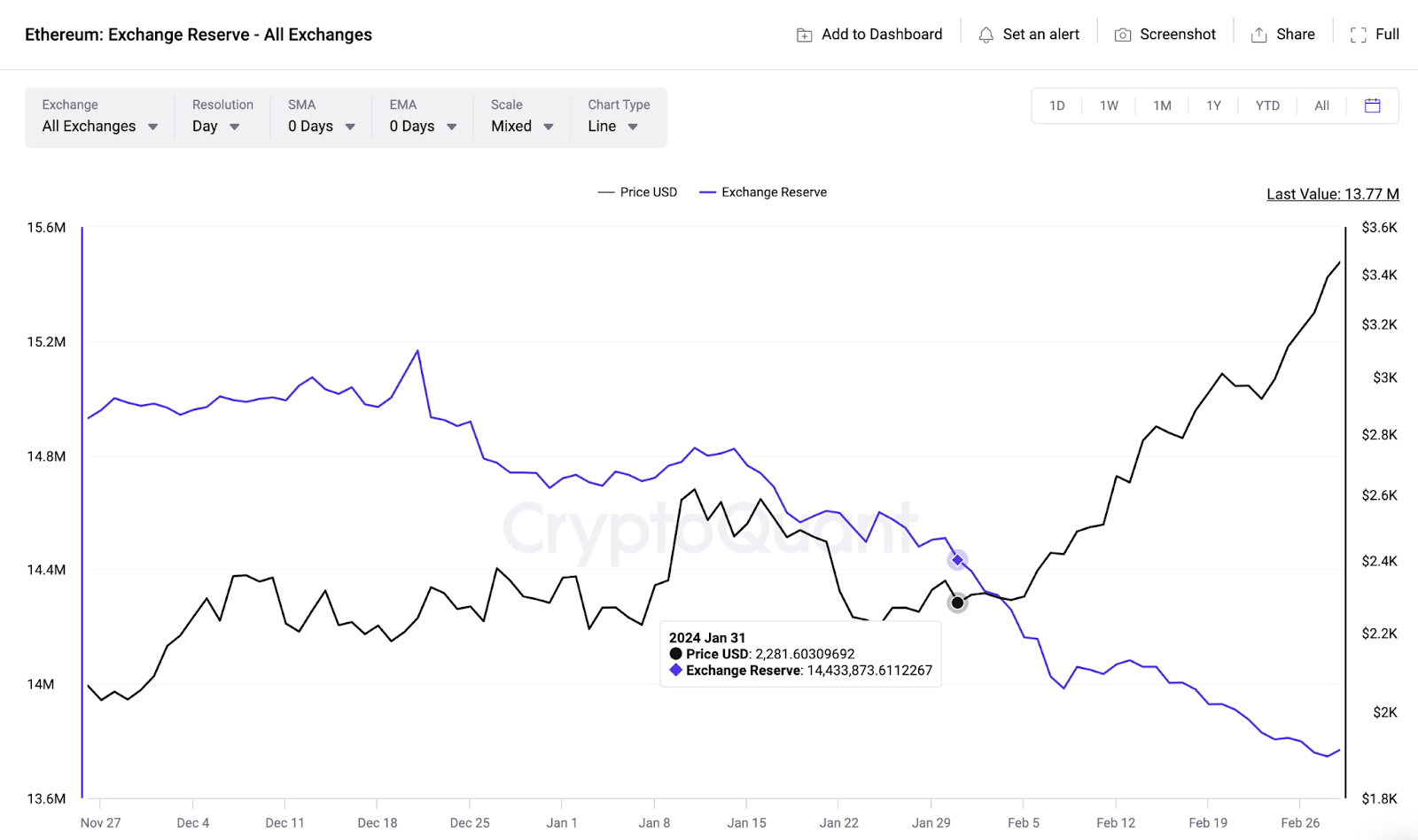

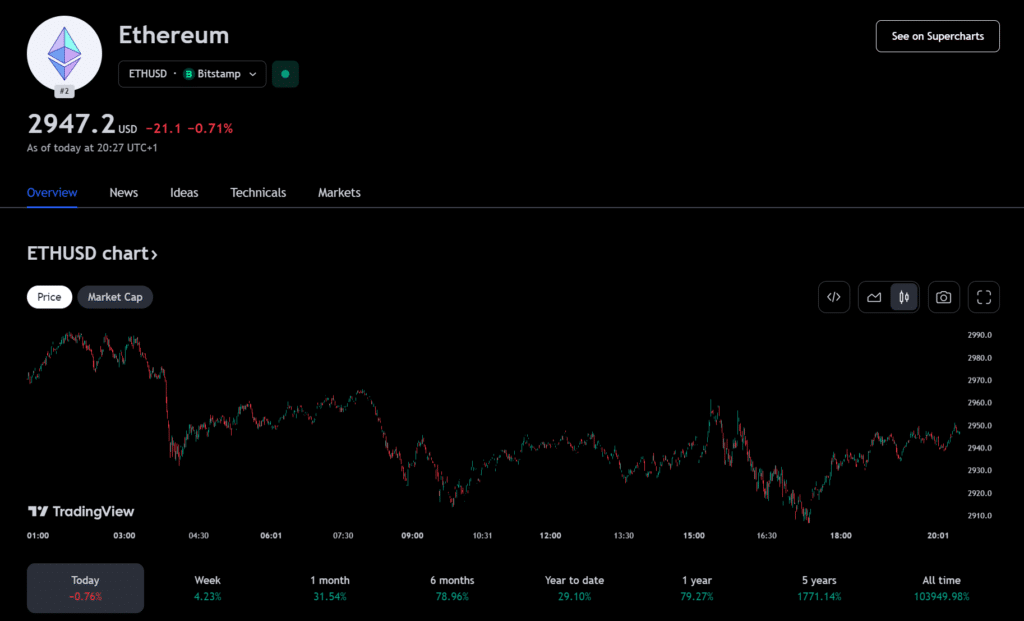

Grayscale research analyst William Ogden Moore said in a Feb. 23 report that Ethereum’s Dencun upgrade has most likely triggered rallies in Ether (ETH) prices. According to CoinMarkerCap, ETH is up 34% in the last 30 days and 28% year-to-date per TradingView.

Ethereum’s Dencun upgrade, scheduled for March 13th, 2024, represents a major step forward and could help Ethereum compete in terms of scalability with faster chains in the Smart Contract Platforms Crypto Sector, such as Solana. We believe that recent price performance reflects the market’s anticipation of this upgrade.

William Ogden Moore, Grayscale research analyst

Dencun promises to uplift throughput and reduce transaction costs, allowing users to spend less gas fees and make more transactions on ETH’s mainnet and layer-2 scaling solutions like Arbitrum.

Developers plan to achieve this key overhaul via proto-danksharding, introducing data blobs.

Moore’s report suggests that Ethereum could seize greater smart contract business share from competitors like Solana if the network can offer cheaper fees. Moore opined that this might unlock a multi-billion market tied to real-world assets.

If Ethereum can simply become more competitive in throughput and cost, it could position itself to capture smart contract applications that demand high levels of security and censorship-resistance like stablecoins or tokenized financial assets.

William Ogden Moore, Grayscale research analyst

Grayscale’s bullish outlook on ETH and its blockchain complements the investment firm’s bid for a spot exchange-traded fund following its successful GBTC conversion last month. According to Yahoo Finance, the company hopes to do the same with its Grayscale Ethereum Trust (ETHE), which holds over $7 billion in assets under management (AUM).

The U.S. SEC delayed a decision on Grayscale’s application till May, along with several other issuers.

[ad_2]

Source link