[ad_1]

If recent on-chain data is anything to go by, then there is a paradigm shift among investors. According to the Real Time Money Flow (RTMF) shared by one analyst on X, capital is moving away from Ethereum and the BNB Chain.

On the other hand, other cryptocurrencies, such as Solana, are receiving a massive influx of capital.

Solana Receiving Billions In Capital

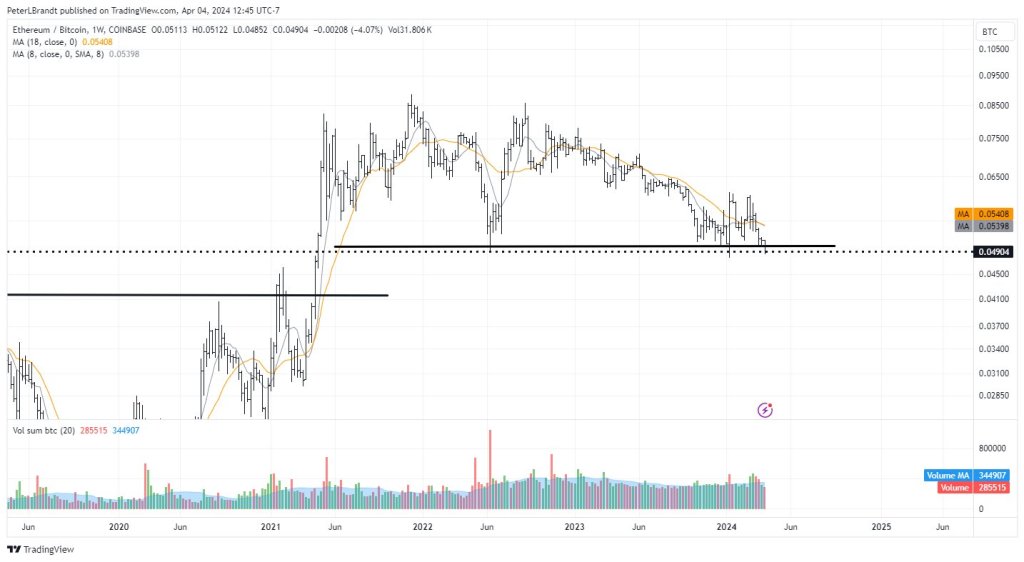

Some observers are now concerned that Ethereum, the leading smart contracts platform, might continue trending lower in the coming sessions as Solana, one of its top competitors, stretches gains, as the RTMF chart shows.

Simply put, the RTMF chart visualizes money entering or leaving an asset. The tool gauges the buying or selling pressure behind every asset. Most importantly, it is a real-time indicator that doesn’t depend on historical parameters like prices or volume to print.

If crypto investors are interested in a particular asset, its RTMF will rise. On the other hand, if it is trending lower, like in the case of Ethereum and the BNB Chain, it might suggest a lack of interest or investors shifting to other assets.

As things stand, some analysts predict a bleak outlook for Ethereum in the current market cycle. Notable, they attribute this shift to a potential bias among long-time holders or even “heavy” investors. The cash migration towards Solana could be due to their value propositions.

For instance, the Solana user base rapidly increases as protocol developers leverage the network’s scalability and low fees. On the other hand, Bitcoin has also seen a spike in its capital influx, primarily due to rising interest from institutions following the approval of spot exchange-traded funds (ETFs) in January.

Will Ethereum Labor For Gains This Cycle?

One analyst argues that Ethereum will likely continue to “suffer” in the coming months, especially as competition heats up and users find value in alternatives.

To support this assessment, the analyst said that despite Ethereum’s broad base and some users’ confidence in its ability to become a store of value, it falls short of competing with Bitcoin. Moreover, Ethereum still struggles with high gas fees.

Meanwhile, a bullish case is building for Solana. Last week, the FTX Bankruptcy Estate sold its $1.6 billion holding of SOL at $64 to crypto venture capitals Galaxy Digital and Pantera Capital.

These coins won’t be liquidated. Instead, they will be restaked and locked for four years.

Feature image from Canva, chart from TradingView

[ad_2]

Source link