[ad_1]

With the merge complete, Ethereum’s long-term roadmap for scalability is now solidified. And with this, it has rekindled an age-old debate: will the future consist of an ‘Internet of blockchains’ or a ‘World of dapps’ on a single chain? Here, Denis explores the growth of modular blockchain design, and how it could become the key to achieving scalability and sovereignty for applications while reducing the cost of building a validator set.

– Chris

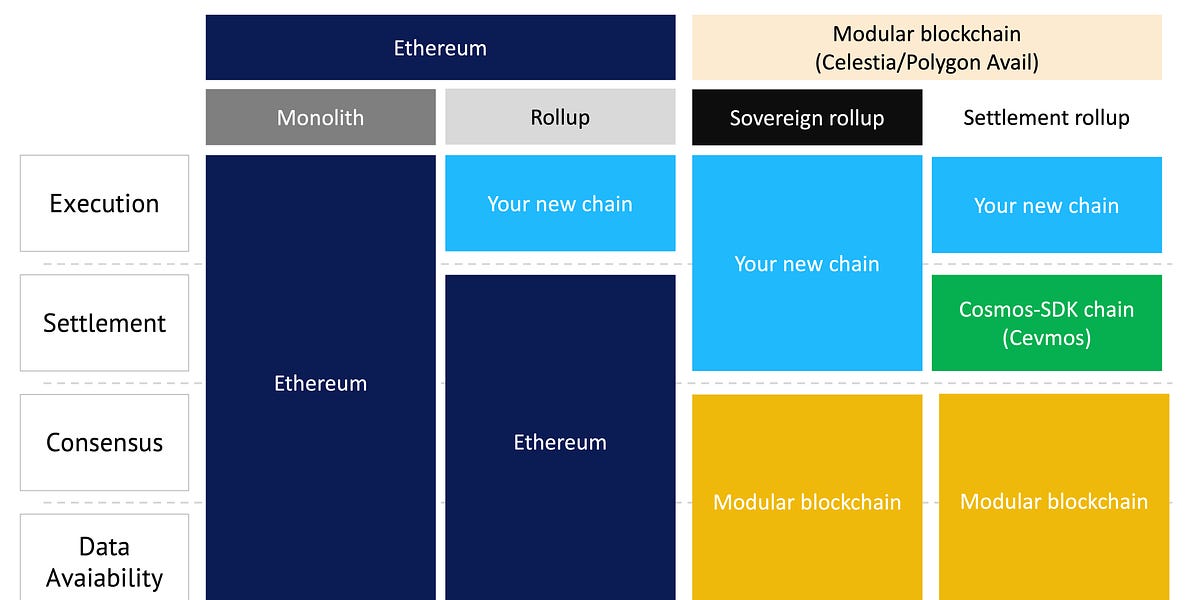

Size doesn’t always equal scale. As highlighted in a previous Dose of DeFi article, a decentralized system must have three layers of technology to function: execution, data availability, and security (consensus/settlement). Monolith blockchains like Ethereum and Solana perform all three, which makes them decentralized, yet not necessarily scalable.

Indeed, while Ethereum’s blockchain is growing fast (and Solana’s even faster), this growth puts ever-higher pressure on validators. As transaction volumes continue to increase, we could well see a data-overload issue as the industry reaches mass adoption.

Throughput during high-load periods presents another problem. For example, NFT mints are short but very demanding on blockchain throughput events. A single popular NFT drop has the power to consume the entire blockspace, causing network congestion. This is what happened during the Bored Ape Yacht Club NFT launch on Ethereum, and creator Yuga Labs subsequently decided to migrate to its own high-throughput chain.

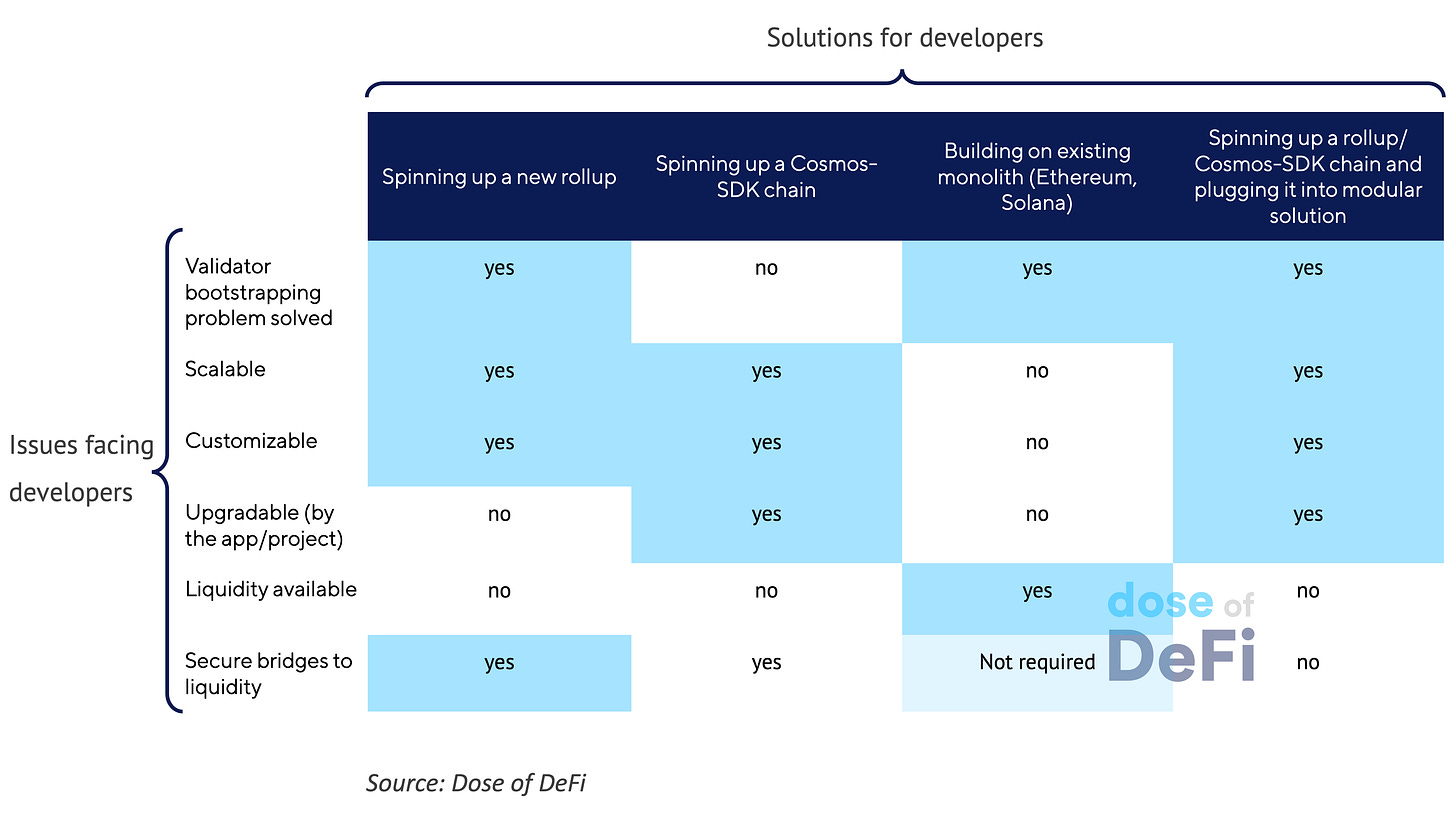

Of course, this is web3, so solutions on solutions are already up and running. Rollups have become the default response – yet are now perhaps suboptimal when compared to where innovation looks set to lead us. In this piece, we explore how rollups and appchains are evolving to best overcome scalability and other issues. And how with new approaches to chain design, a world in which modular blockchains are the norm becomes a realistic future.

Rollups are the predominant current solution to the scalability issue, with Vitalik’s rollup-centric vision of the future now seemingly coming to life. Rollup technology delivers speed and throughput by being a fast, scalable separate blockchain that saves only zipped archives of its transactions to an L1. While zero-knowledge rollups are yet to be battle-tested, optimistic rollup technology has been trialed, with projects like Arbitrum and Optimism reliably serving users for about a year now. Rollups also can be effective when extremely high throughput is needed for a short period.

Rollups do have a weakness though: they aren’t upgradable. Or as the team at Celestia puts it:

The eventual goal of current Ethereum rollups is that the rollups should not be upgradeable by a multisig or a committee, because if they can, they are not trust-minimized as funds can be stolen via an upgrade. In this model, rollups can only be upgraded by hard forking the L1 because the canonical chain is defined by the L1’s settlement layer, meaning the rollups have no sovereignty.

Celestia and Polygon Avail (and probably others that we’re not yet aware of) are new blockchains that have been specially designed to solve the data availability problem, in what is called ‘modular blockchain’ architecture. These blockchains don’t verify transactions, but simply check that each block was added by consensus and that new blocks are available to the network. Scroll to the end for a more detailed description of how this works*.

How would this design approach work with rollups? As the Celestia team explains in the same blog post,

Rollups do not post their blocks to a smart contract, but directly onto data availability chain as raw data. The Celestia consensus and data availability layer doesn’t interpret or perform computations on the rollup blocks, nor run an on-chain light client for the rollup.”

Polygon’s Avail works in a similar way.

Using such a design means rollups are no longer hard coupled with L1s, and so can be upgraded and are therefore ‘sovereign’. Rollup upgradability means important decisions about governance, technology, or strategy don’t need to depend on L1s – and this full control will be attractive to DAOs, or any large projects. Many projects want to build their own rollups, and if they do, the customization and upgradability aspects of the modular approach are sure to make it a popular route.

Indeed, Celestia’s first partners (or ‘Modular Fellows’, as it calls them) are mostly projects that enable easier rollup deployment by utilizing Celestia’s data architecture, which is designed to store rollup data, not transactions. Important examples include:

-

dYmension: ‘Home of the RollApps’. This allows rollups to issue tokens and choose which data availability layer to use (e.g. Celestia or Polygon Avail).

-

AltLayer: Ethereum-compatible tailored rollups-as-a-service. These are high-throughput ‘disposable’ rollups, where NFTs are minted and then bridged to an L1.

-

Eclipse: Rollups using the Solana VM and the Inter-Blockchain Communication protocol.

Of course, nothing is perfect. Sovereign rollups have disadvantages too – most notably, a lack of liquidity compared to large L1s (especially right after rollup launch). Bridges can be built to bring liquidity to the rollup, but these can’t be as secure as non-upgradable smart contract bridges. Vitalik made this point clear in this post:

To be a rollup that provides security to applications using Ethereum-native assets, you have to use the Ethereum data layer (and likewise for any other ecosystem)… There are fundamental limits to the security of bridges that hop across multiple ‘zones of sovereignty’. This is a limit to the ‘modular blockchains’ vision: you can’t just pick and choose a separate data layer and security layer. Your data layer must be your security layer.

Since Bitcoin launched, there has always a push for faster blockchains, but once real applications emerged on blockchains, then blockchain architecture design could be customized to the needs of a specific application, aka appchains. That’s why dYdX chose an appchain to accommodate their unique requirements: on dYdX, per every 1,000 order places/cancellations, only 10 trades are executed, meaning they must set-up transaction fees in a way that users only pay for executed trades. To achieve this, each validator runs an in-memory orderbook that is never committed to consensus (i.e., off-chain).

With appchains, launching a wholly-customized chain is possible, as we discussed in this earlier article. While Cosmos SDK and Substrate are currently the most popular frameworks for appchains, the former has achieved far greater adoption success, so we focus on it here.

These are some of the notable projects leveraging Cosmos SDK customizability to implement unique features:

-

dYdX has free transactions for unexecuted orders; validators are designed to store the orderbook.

-

Osmosis enables superfluid staking and cryptography for MEV protection.

-

Agoric supports smart contracts written in JavaScript.

-

Archway distributes incentives to developers directly from smart contracts.

The downside of appchains is the need to distribute token and bootstrap validators for a new chain, while still ensuring decentralization. This could well be an expensive undertaking; validator capitalization on this table hints at the scale required.

Celestia and Polygon Avail aim to solve this problem by allowing any chain to tap into the modular blockchain’s existing validator network. Celestia will likely issue a token to bootstrap its validator network. And for Polygon Avail, it seems likely they will use the $MATIC token, probably with the existing validator set.

Modular blockchains are indeed taking the first steps to onboard appchains. To be able to start onboarding Cosmos SDK chains, the Celestia team developed Optimint. This is a replacement for Cosmos SDK’s consensus framework Tendermint, that publishes blocks to Celestia instead of going through the Tendermint consensus process. Evmos has already announced it will be Celestia’s first partner from the Cosmos network, in what has been dubbed Cevmos (C stands for Celestia).

Being able to save on validator bootstrapping sounds attractive, especially for smaller projects, such as games or NFT platforms. This saving coupled with full customization makes the concept of an appchain plugged into a modular blockchain a strong one.

Through 2022, rollups and appchains have started addressing blockchain scalability problems – with the latter also overcoming customization limitations. Yet there’s always improvements to be made, and modular design looks set to solve the weaknesses of rollups and appchains. But will there be demand for such design, given the disadvantages?

Having full control over your rollup is a good proposition for large teams with strong blockchain development backgrounds, such as DAOs. Such teams would likely appreciate the customized throughput settings, consensus rules, and even VM choice. Plus, there’s the aforementioned savings on validator bootstrapping that’s especially attractive to smaller projects.

Polygon claims that with modular blockchains, the vision of an Internet of blockchains is finally becoming a viable possibility. Celestia seems to concur; its team expects tens of rollups/chains to tap into its network over the next three to five years.

To summarize: modular blockchains bring scalability, full control, chain customization, and savings on validator bootstrapping. Yet still there are tradeoffs: namely in liquidity and cross-chain security. We expect to see modular blockchains occupy the niche of highly-customizable solutions for technically-advanced teams on one end of the spectrum, and for small, cost-conscious teams on the other.

* Light nodes need to be able to determine if certain data is available or not without downloading the full blocks. Instead of downloading the entire block, light nodes just download small random samples of data from the block. If all the samples are available, then this serves as proof that the entire block is available. By sampling random data from a block, it can be probabilistically verified that the block is indeed complete. Refer to this podcast transcript for more details.

-

Various MEV dashboards Link

-

Uniswap misses out on LUSD volume, Curve and Balancer fill the void Link

-

New fund flows dashboard from DeFi Llama Link

-

Cow Protocol now supports ERC-1271, enabling “gas-less-ly” trades Link

-

Succinct launches first proof of consensus bridge Link

That’s it! Feedback appreciated. Just hit reply. Written in Nashville where the leaves are still turning.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

[ad_2]

Source link