[ad_1]

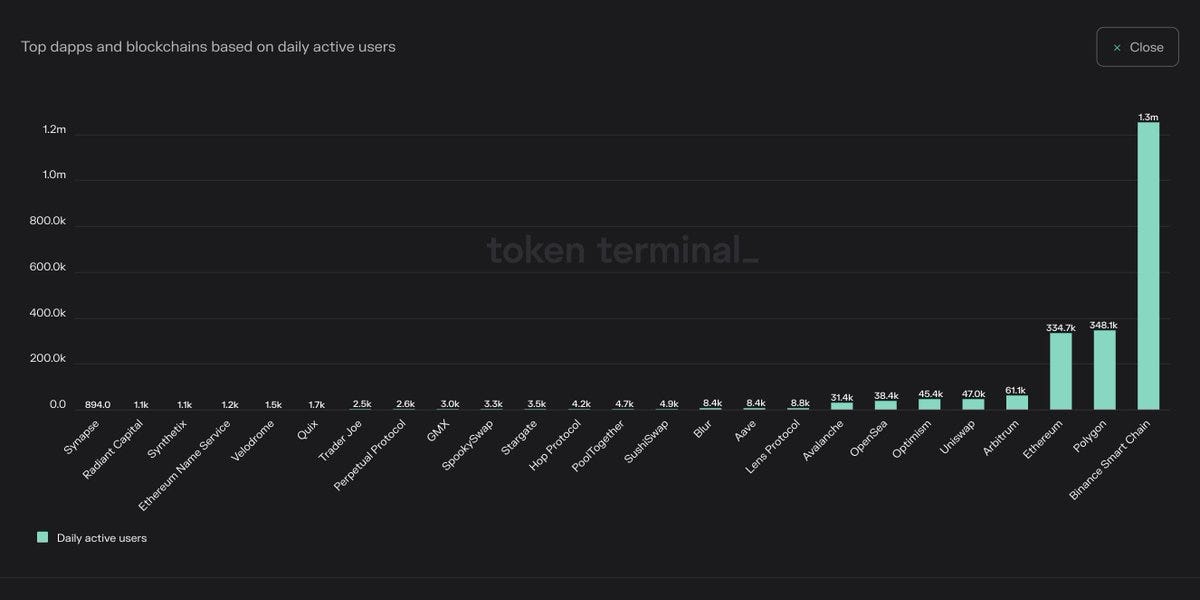

A top five that all should be satisfied with their market positioning. CZ’s stature has grown during the FTX saga, but BNB Chain may still be a sleeper success. Polygon seems prime to soak up big Web3 entries, while Ethereum boasts a significant user base despite the high gas fees. Ethereum’s user base is playing at much larger scales than BNB & Polygon. Arbitrum, meanwhile, is leading the blockchain scaling race and Uniswap is winning the most widely used blockchain application.

GMX has maintained steady volume despite the overall market decline. Just this week, GMX fees surpassed Uniswap in daily fees for the first time. There has been a long list of projects trying to crack the on-chain perpetual and derivatives market with little success. GMX’s growth has been on the backs of retail investors, but it’s unclear if GMX’s model can scale to attract institutional capital and compete with the centralized players.

The chart above is one of 10 positive (adoption) charts from crypto apps/protocols from

.

-

crvUSD Whitepaper drops Link

-

ENS DAO selects Karpatkey as treasury manager Link

-

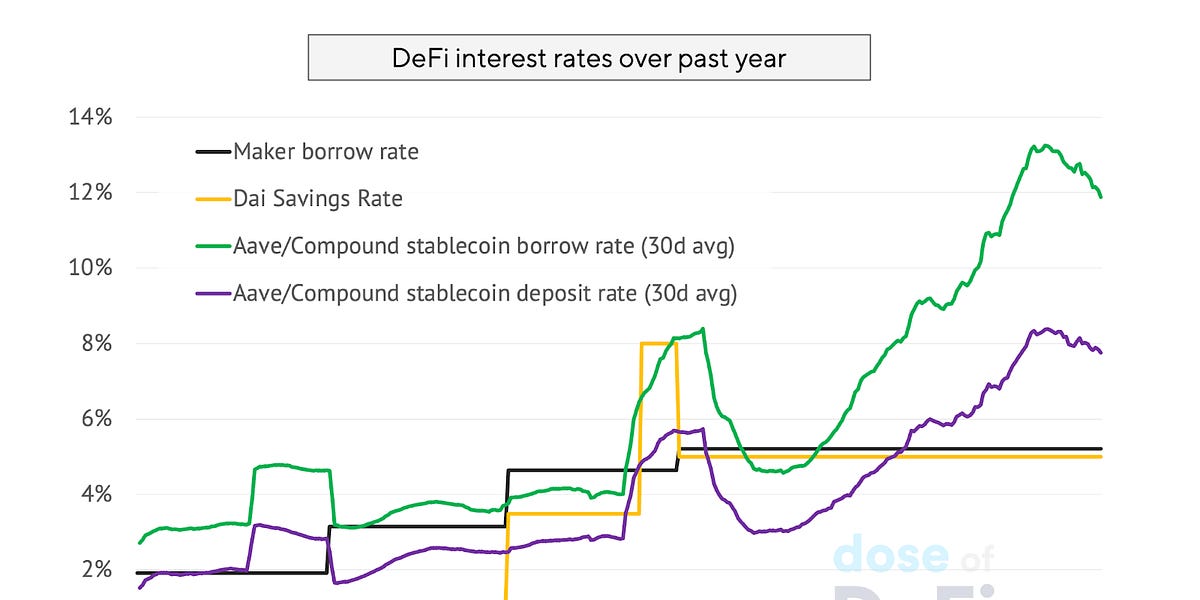

MakerDAO votes to raise Dai Savings Rate to 1% Link

-

Gauntlet runs down the Aave governance response to the CRV squeeze Link

-

Across Protocol raises $10m from Hack, Placeholder & Blockchain Capital Link

-

Avalanche DEX Trader Joe to deploy on Arbitrum Link

That’s it! Feedback appreciated. Just hit reply. Written in Nashville, where I can’t believe it’s December.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. Caney Fork, which owns Dose of DeFi, is a contributor to DXdao and benefits financially from it and its products’ success. All content is for informational purposes and is not intended as investment advice.

[ad_2]

Source link