[ad_1]

This is part 2. Check out part 1, MEV resolutions: Are we there yet?

As we discussed last month, the MEV ecosystem is growing rapidly. Instead of trying to solve MEV, focus has shifted to incorporating it into application and protocol design. MEV mitigation and democratization have become the most important things in DeFi (and arguably, all of Ethereum). Yet while MEV mitigation efforts are necessary to make Ethereum easy to use, the solutions emerging over the past year (while competitive), have come at the expense of decentralization.

This has led to soul searching over the true goal of the DeFi ecosystem. Is it creating products that are competitive with TradFi and centralized crypto exchanges? Or is it achieving some undefined decentralization end point?

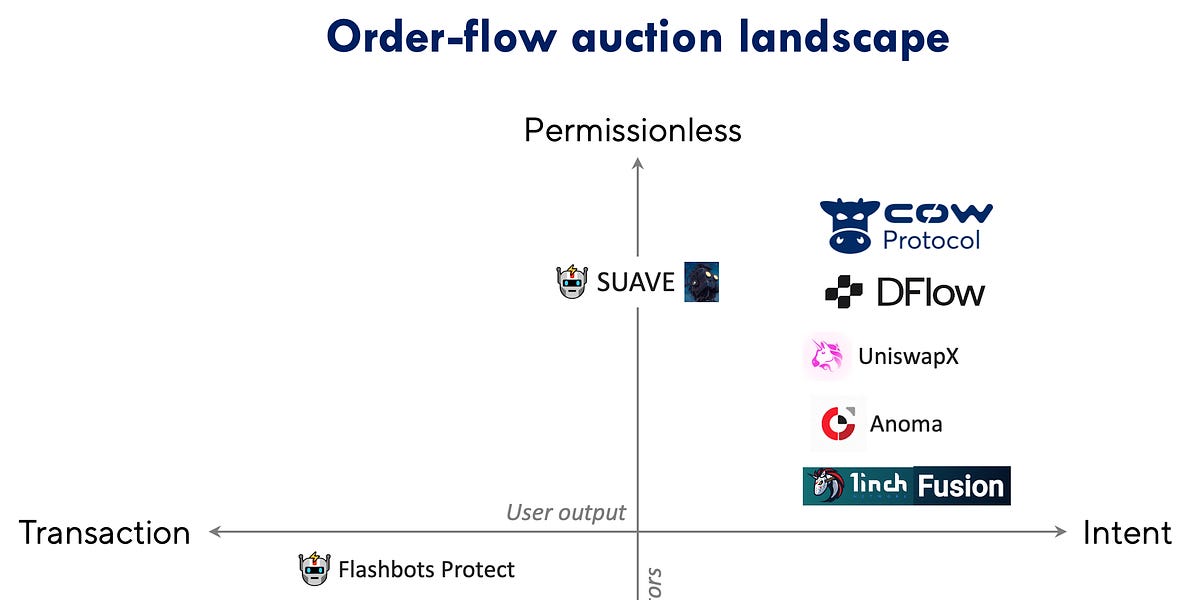

This debate is best exemplified by the recent rise in order flow auctions (OFAs), the MEV mitigation strategy that returns the value extracted back to the end user (for a fee).

There are many different solutions in the works (and we discuss the main ones later on), but they all follow the same pattern:

-

Order routing and execution are delegated to specialized networks outside of Ethereum.

-

This intermediate computation layer relies on trusted actors to mediate between users and validators.

-

These new networks empower sophisticated (and centralizing) market makers, but this comes at the expense of on-chain liquidity.

Is non-custodial trading with professional market makers inevitable for DeFi? Decentralizing the MEV supply chain and democratizing MEV rewards are hurdles to clear, but this will not be the catalyst of new innovative DeFi products that conquer CeFi and TradFi.

Let’s first do a stock take on the more recent approach to MEV mitigation. Over the past year, there has been a huge shift in how DeFi users trade on Ethereum. Increasingly, they are sending their trades not to the public mempool but to private networks that fill and execute orders and return a portion of the MEV extracted back to users. These OFAs, where searchers/solvers/fillers bid on the right to execute orders using both on and off-chain liquidity, come in all shapes and sizes

These networks serve as trusted (for now) intermediaries. On one side are retail users and the other is a set of market makers, bidders, searchers or solvers, which we’ll refer to as facilitators. Shifting order routing off-chain to facilitators yields a significant gas cost savings, while users get better prices because facilitators can also use off-chain liquidity. Facilitators could theoretically trade against their users (frontrun or sandwich) but this would jeopardize their future flow. So, it’s in the best interest of the OFA networks to ensure facilitators are not acting maliciously.

OFAs have different ways of policing facilitators. Some only allow certain entities to bid for order flow (permissioned), while others allow anyone to participate but can retroactively punish bad actors (either by slashing a stake or just banishing them from the network). Others allow facilitators to bid for orders permissionlessly by using a batch (CowSwap) or Dutch auction (Uniswap X, DFlow, and 1inch Fusion). This requires additional time for the auction to complete and the OFA network must still trust that the block builder is not extracting MEV when it passes along the transaction bundle to validators.

There’s now a feverish rush to redirect all retail flow from the public mempool to private OFA networks. Uninformed retail traders are the source of MEV, so anyone that controls that flow can attract the best facilitators and market makers to their network. OFA networks are targeting wallets and RPC providers, as well as building their own front-ends. Owning retail flow is therefore the most important part of the MEV supply chain.

In evaluating the rise of these OFA networks, we also need to remember a key differentiator: between those whose input is the user’s transaction, versus those that are a user’s intent. Intent is a made-up term – crypto is very good at that – to describe a user’s desire for a certain outcome, rather than a transaction, which is specific lines of code to execute. Flashbots’ Quintus Kilbourn and Paradigm’s Georgios Konstantopoulos define it succinctly:

If a transaction explicitly refers to “how” an action should be performed, an intent refers to “what” the desired outcome of that action should be. If a transaction says “do A then B, pay exactly C to get X back”, an intent says “I want X and I’m willing to pay up to C”.

For most users interested in executing a swap at the best price with the lowest fees, using an intent-based architecture is ideal. Most users don’t care how their order is executed, only that whoever executes it abides by conditions defined by the user.

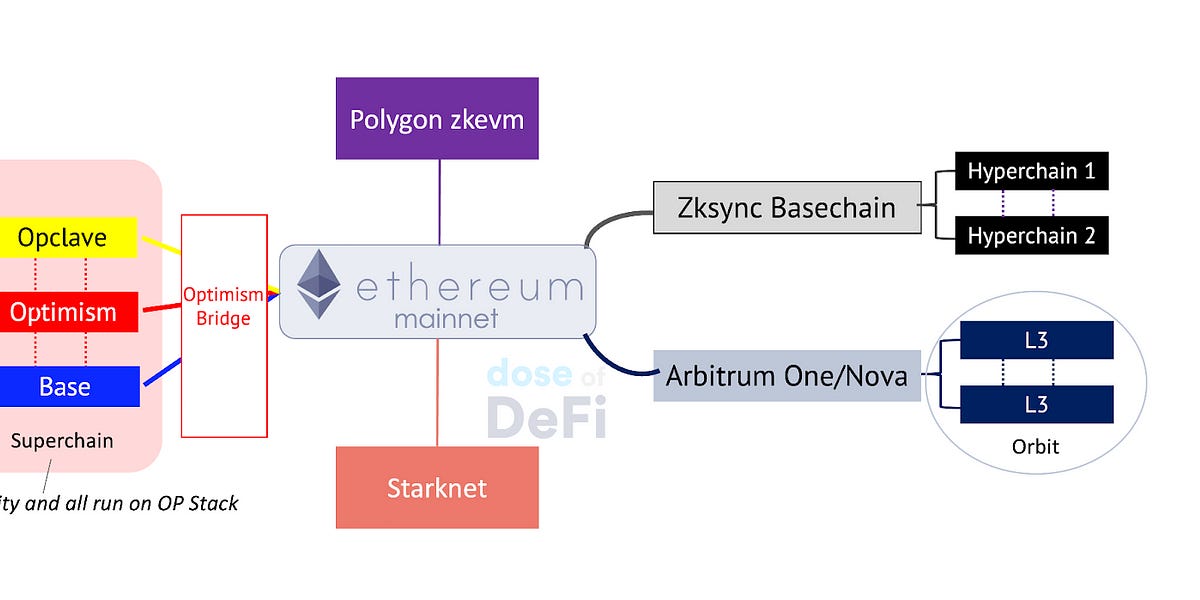

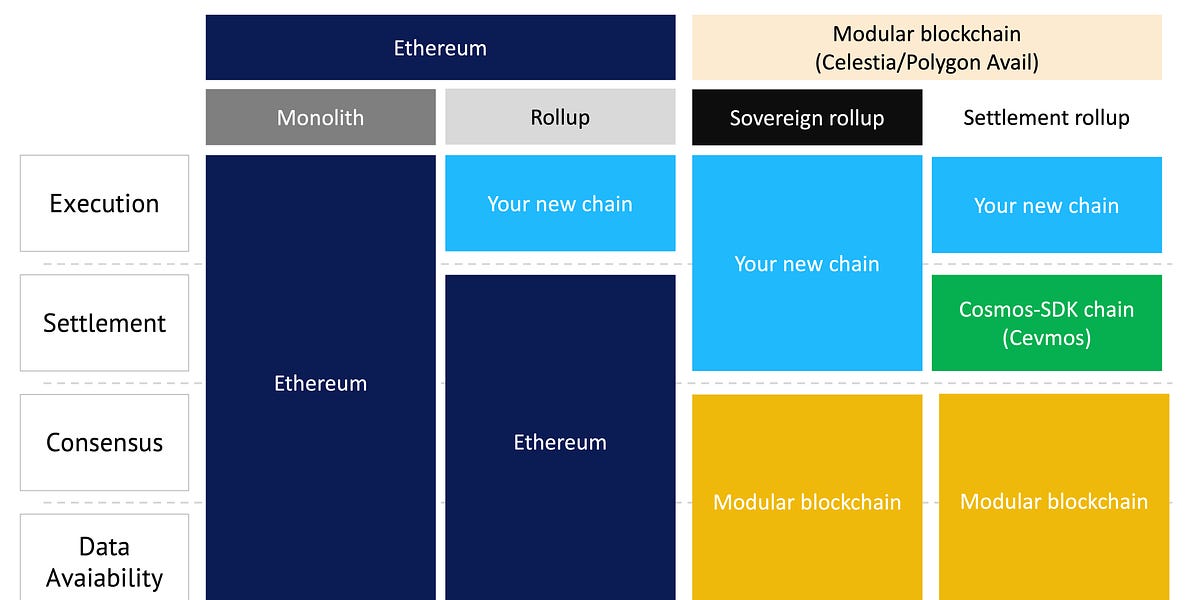

This harkens back to the classic debate on whether blockchains are best thought of as a world computer or a global settlement layer. Clearly, there are benefits to smart contracts and trustless execution, but at what cost? It also fits into the trend of moving execution to Layer 2s in general. The difference being that when using Arbitrum or Optimism, you are using the same execution engine as Ethereum (the EVM) and posting a proof of the execution on Ethereum. OFA networks and intent-based blockchains (like SUAVE, Anoma, or DFlow) will also need to offer similar trust assurances, if they want to maintain the same trust assumptions as execution on Ethereum.

Efforts to mitigate the negative externalities of MEV via OFA networks have had one obvious casualty: on-chain liquidity. All efforts to route trades to private OFA networks mean that facilitators have the first look at filling orders. Facilitators can tap into liquidity offered by on-chain automated market makers like Uniswap, Balancer, and Curve, but they will only get flow when facilitators decide it’s not worth using their own liquidity. On-chain liquidity providers are already getting slammed by CEX-DEX arbitrage and problems from loss versus rebalancing (LVR), but in the new market architecture to minimize MEV, they will also forfeit their exclusive access to retail DEX traders.

So, are on-chain liquidity and MEV mitigation really mutually exclusive? Not everyone thinks so. Current efforts to minimize MEV extraction while still empowering on-chain liquidity providers (LPs) are underway. The simplest method is to return MEV from CEX-DEX arbitrage back to LPs. The process goes like this: A price change on Binance leads to a rush to trade against Uniswap LPs that have not yet incorporated the new price. There’s a huge amount of value to be extracted from whomever gets to trade against the LPs first. The McAMM (MEV capturing AMM) design would auction off the right to the first trade per block and return the proceeds to LPs.

Empowering LPs is also the foundation for Uniswap v4 and Ambient Finance, which we called “Fresh hope for passive LPs” in a deep dive in June. Both of these AMMs enable pools to be programmed with “hooks”. The design space for these has not yet been fully explored (Ambient launched in June and Uni v4 has yet to fully launch), but they could impose restrictions on who can trade with a liquidity pool. Theoretically, they could only allow trades from certain OFA networks or private mempools. This means retail flow could be aggregated and only given to specific Uniswap/Ambient LP pools. More importantly, hooks could be designed to protect LPs from toxic flow but it also might limit arbitrageurs rebalancing the pool. Just a few weeks ago, Arrakis released Diamond Hook, a Uni v4 hook meant to alleviate LVR concerns for LPs, although some question whether it can achieve its mission.

The efforts to resolve the MEV crisis are rejiggering the entire DeFi landscape, so it’s worth taking a step back to ask, what are we trying to achieve? We’ve been writing about DeFi for almost five years because of the earnestness of those working in it to build a better financial system (despite a lack of consensus on what this actually is!)

To us, DeFi has three value propositions that make it a financial system that conceptually doesn’t enshrine market winners as long-term rent extractors:

-

DeFi is transparent. FTX couldn’t happen on-chain because DeFi is non-custodial. BlockFi couldn’t happen in DeFi because the loan book is open and liquidations are automatic.

-

DeFi is global first. National regulators can restrict access at the application layer, but DeFi’s default setting is open access around the world.

-

DeFi unlocks new financial products and innovations through programmable money and creates an open platform for others to permissionlessly build on top of, much like the internet.

Does the existing MEV supply chain maintain these principles? It’s too early to tell, but there are some red flags. OFAs do not (yet) offer the same transparency as on-chain execution. Facilitators are becoming more sophisticated and it’s possible that we will end up in a world where fillers/solvers/searchers are all large Wall Street market-making firms. This is not inherently a bad thing, but industry concentration makes it an easy target for regulators and threatens DeFi’s global nature.

As for unlocking new financial products and innovation, OFAs are focused on best execution and the current structure seems an awful lot like the one Robinhood and Citadel already pioneered.

Even if this became the end state for DeFi, three huge innovations would still have been unlocked:

-

Non-custodial trading: The original motivation for creating decentralized exchanges was to allow users to maintain control of their crypto and protect against the risk of hacks, inside jobs, and self-dealing at centralized crypto exchanges. An intent-based DEX settled on Ethereum fulfills that vision.

-

Bootstrapping liquidity for long-tail assets: Even if sophisticated market makers are the primary liquidity providers for blue chip assets, on-chain AMMs are still the best way to bootstrap liquidity – and a valuable innovation for the long-tail of assets. Those around in pre-Uniswap times will remember how hard it was to build a liquid market on primitive DEXs like Ether Delta. Permissionless on-chain liquidity pools are an infinitely better option than the shady business practices of CEX listings.

-

On-chain lending pools: The lending side of DeFi has not been as obsessed with MEV as DEXs. While there are issues to overcome (namely around oracles), on-chain credit markets are just getting started, and have continued to produce new, interesting products even in the bear market.

Lots of promising MEV mitigation strategies are emerging, but what ultimately wins out is less important than moving past MEV as the focal point of DeFi. The key consideration for any blockchain’s MEV ecosystem is whether MEV extraction or redistribution threatens the three DeFi value propositions we outlined above. Centralizing elements in the MEV supply chain will imperil all three.

So who’s doing it well? dYdX and the Cosmos ecosystem are using the appchain model and on-chain governance to ensure that their validators are not extracting MEV – or at least are transparent about it. This means the chains can stay focused on building great DeFi products. Skip Protocol is a sovereign MEV infrastructure provider underpinning most of the advances in the Cosmos MEV ecosystem.

The rise of OFAs is a necessary step in protecting DeFi users against the dangers of the dark forest. We are most encouraged by SUAVE, Flashbots’ new blockchain (set to launch a Devnet in Q4), because it offers better transparency in execution, privacy protection, and a credible path to decentralizing block production. Decentralized sequencers for Layer 2s, like Espresso or Astria, are not too dissimilar.

Ultimately, we drink the kool-aid on intent-based systems, and think the delayed auction format used by CoW, Uniswap X, DFlow, and 1inch Fusion is the best market structure to prevent centralization of facilitators while remaining permissionless. Transparency in intents execution is still sorely needed.

Decentralized OFAs will not be enough to beat CeFi. New primitives are needed. The most promising development in MEV mitigation and DeFi innovation more broadly is the new DEX design of Uniswap v4 and Ambient Finance. These are the first DEXs to be designed with MEV mitigation strategies. The concept of “hooks” allows LPs to discriminate between toxic and non-toxic flow, which could finally generate positive returns for LPs.

Many DeFi users were turned off by the rise of MEV due to the constant fear of getting taken advantage of. This rightly drove research into mitigating problems for the average user. The all-encompassing nature of MEV has made it feel like the only game in town. It’s incredibly important to fix, but new types of MEV extraction and redistribution won’t be what drives innovation in DeFi, nor what makes it successful long term. The key to any MEV solution must be one that allows for DeFi to return to its roots: a transparent, global financial system where entrepreneurs can build new financial products that are unlocked through smart contracts and programmable money.

To put our cards on the table, we strongly believe that DeFi will only work long term if there is transparency in how orders are executed, and if retail users can earn some positive return by LPing. Of course, sophisticated actors should be able to earn a higher return, but DeFi will have failed if it can’t produce more than an updated version of an on-chain index fund. Others contend that “passive LPing will [never] be profitable” and the goal is to merely return value leaked to LPs to make healthy markets on-chain. In this world, the fees typically paid to Blackrock would be paid to rebalancers in the MEV ecosystem. So DeFi is having your ETF managed by a decentralized market of traders settled on a blockchain.

These are different visions for the future of DeFi, and now that MEV mitigation and redistribution strategies are in place, we will see which one wins out. Our take:

-

PoolTogether launches v5 Link

-

Ethereum foundation gets $9k extracted on on-chain ETH trade Link

-

Ethereum mempool transactions now on Dune Link

-

Elixir, DeFi protocol aimed to increase orderbook liquidity, raises $7.5m Link

-

Over $500k in cumulative fee revenue for Uniswap labs from front-end fee Link

-

USDC supply dropped 44% since ATH to $23bn Link

That’s it! Feedback appreciated. Just hit reply. Special thanks to Daniel MacLennan for discussion and feedback on today’s post. Written in Nashville. Happy fall y’all.

Dose of DeFi is written by Chris Powers, with help from Denis Suslov and Financial Content Lab. All content is for informational purposes and is not intended as investment advice.

[ad_2]

Source link